Interest Certificate

If playback doesn't begin shortly, try restarting your device. You're signed out. Videos you watch may be added to the TV's watch history and influence TV. Applying for your Certificate. After completion of all requirements, you must complete an application for the Certificate in Public Interest. Submit a completed application to the Director of Public Interest Programming for signature. You must then submit your signed application form to the Law School Registrar's Office.

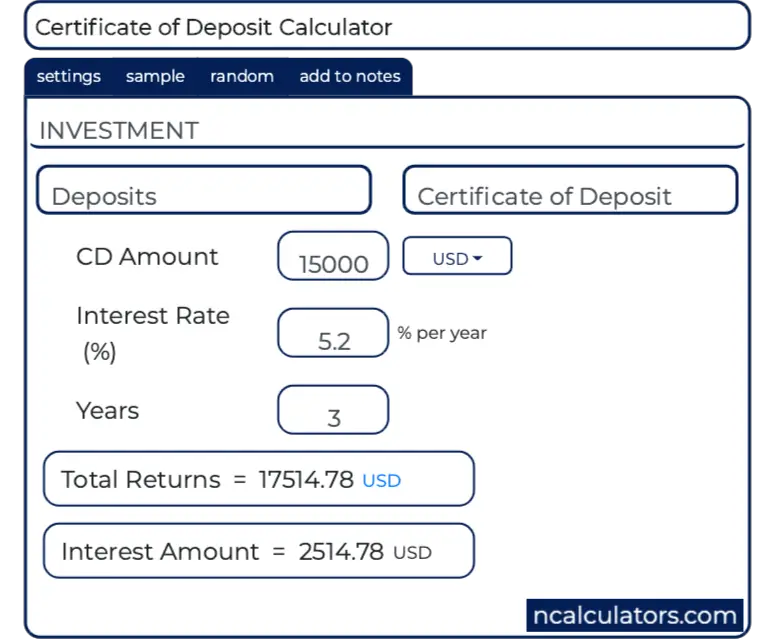

See what you could earn with an Ent Certificate.

The longer you can wait, the more you can earn!

Minimum Deposit

$500

How It Works

Our trusted standard certificate earns great rates on 3- to 60- and 84-month terms. Also available as a Traditional, Roth or Educational Savings Certificate. You can compare certificates with our calculator.

Minimum Deposit

$5,000

How It Works

Our flexible priority certificate offers one-time rate bump1, add funds2 and withdrawal3 options on 24- to 36-Month terms. Also available as a Traditional, Roth or Educational Savings Certificate. You can compare certificates with our calculator.

Interest Certificate Axis Bank

New to saving? Try these great starter certificates!

Make saving simple! Get started with just $25 and add to your certificate at any time with no penalties. Set up auto-transfer to save even more!

My Savings Starter Certificate

Build your savings fast! Requires monthly automatic transfers of at least $5 from another Ent account and auto-renews until you reach a max balance of $1,000.

Make additional deposits

Under 18? Get even better rates with a Youth Certificate. Learn More

Common Questions

A certificate is an account that allows you to store your money for a set number of months and earn dividends on that cash. Generally, the longer you keep the money in your account (i.e. the longer the term), the higher rate you can earn. You will usually not be able to access the money in this account before the end of the term. At maturity, your certificate will automatically renew for the same term length you chose originally.

A certificate has matured when it reaches the end of its term. At maturity, you can remove your funds from the account and access all the dividends you earned. Just make sure you notify us before maturity, so your money doesn’t automatically renew.

Provisional Interest Certificate

The rate for a regular certificate will remain the same through the entire term. If rates go up or down during that time, your account will not be affected. If you select a priority certificate you will gain several advantages. First, you can use a one-time rate bump1 when rates increase in the middle of your term. Second, you have the option to add funds one-time during the first year of the term2. Finally, you can even withdraw money one time of up to 50% of the balance before the term has ended.

Interest Certificate Sbi Online

Interest Certificate Application

If you put at least the minimum deposit into the account and do not touch your funds for the length of the term, you won’t have to worry about penalties or fees. A penalty is imposed if funds are withdrawn before the maturity date. See full details in Ent’s Certificate Disclosure under Important Account Information.